NORNORM closes financing from Santander CIB guaranteed by the European Investment Fund to fuel expansion in Europe

This collaboration reinforces NORNORM's commitment to driving sustainable growth and innovation in the furniture subscription industry while advancing circular economy initiatives.

Copenhagen, Denmark July 1, 2024 – NORNORM, the leading provider of circular workplace furniture solutions, announces it has closed financing with Santander Corporate & Investment Banking (Santander CIB) and the European Investment Fund (EIF), securing a significant debt facility to boost growth. This collaboration reinforces NORNORM's commitment to driving sustainable growth and innovation in the furniture subscription industry while advancing circular economy initiatives.

With over 350,000 square metres of workspace furnished and an impressive 50% annual growth in contracted square metres for 2023, NORNORM's strong business fundamentals are evident. The company is well-positioned to tap into the burgeoning office furniture market, estimated at EUR 201 billion, leveraging its innovative approach to office furniture and circular economy principles.

NORNORM benefits from support from the European Union under the InvestEU fund. This financing, alongside previous funding totaling €110M, empowers NORNORM to expand its market reach to the UK, France, and Germany, enhance its business model, innovate and revolutionise the office furniture landscape. NORNORM, a Nordic scale-up business, is committed to sustainable growth and sets a new standard for responsible business practices in the furniture subscription industry through its furniture-as-a-service model that has attracted thousands of customers, including Electrolux, Volvo and Netflix.

Santander CIB spearheaded the debt financing round while the EIF played a crucial role in supporting NORNORM's growth by providing financial backing.

Ignacio Yllera, Executive Director of Growth Financing at Santander CIB, said: “We are delighted to provide NORNORM with this facility which will support their growth, expand their business and strengthen their leading position in circular workplace furniture solutions.”

Emil Steenhouweer, CFO at NORNORM, stated: “With this partnership, we are poised to accelerate our mission, bringing circular office furniture to more corners of the world and proving that sustainable practices can drive exponential growth.”

By finalising these agreements, NORNORM has successfully secured the capital necessary to sustain the growth trajectory. The EIF guarantee accompanying the financing represents a pivotal validation of NORNORM´s circular strategy. Notably, Verdane was the pioneering growth investor to endorse our endeavours, and together with Deloitte provided invaluable advisory support.

NORNORM has achieved remarkable success in the Nordics, revolutionising the furniture industry with its innovative subscription-based model. With more than 350,000 square metres of furnished space. In only three years, NORNORM changed the game and has become a category leader in Furniture as a service with a fully circular business model. NORNORM helps businesses cut CO2 emissions by up to 70% compared to buying new furniture, offering office furniture on subscription. This success is a testament to the region's embrace of sustainable practices and modern, adaptable living solutions.

NORNORM's success in securing financing from leading institutions underscores its position as a gamechanger in the circular economy space.

About NORNORM

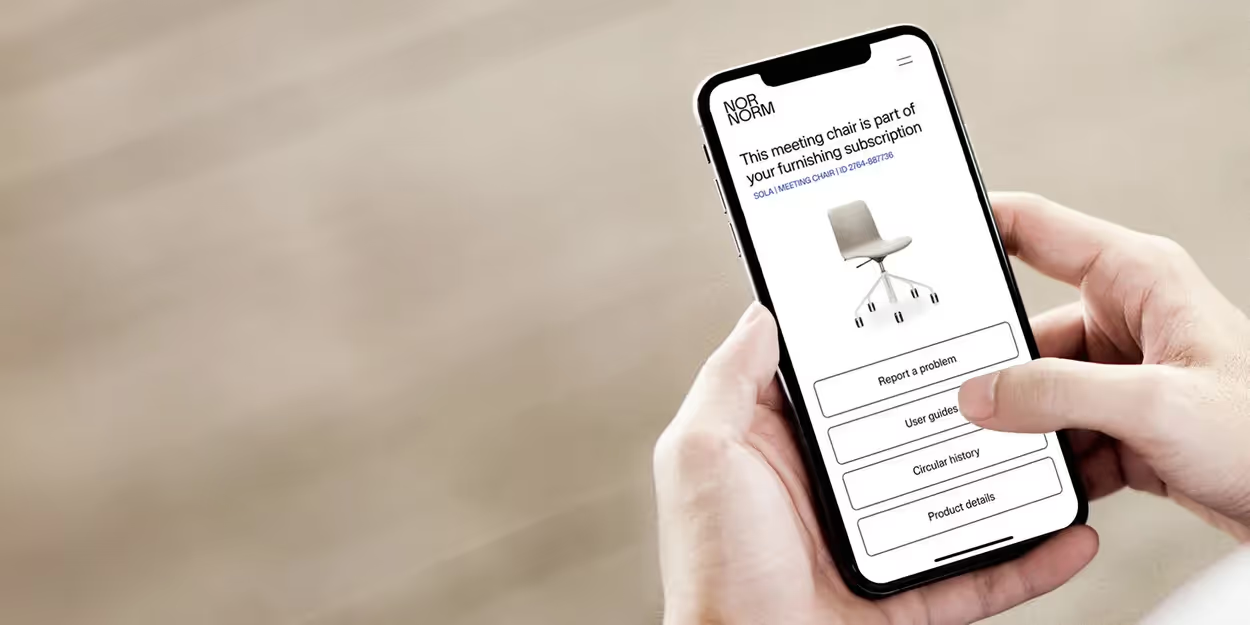

NORNORM provides businesses with attractive workplace furniture solutions based on a subscription model. Requiring neither investment nor long-term commitment, it offers flexibility to scale up or down as the company grows or downsizes. The concept is built on circularity, where every piece of furniture is kept in a loop from one workspace to the next, and every product is carefully maintained and refurbished to extend its lifespan. This is good for business, people, and the planet. Backed by Inter IKEA, Verdane, Philian AB, and Coen van Oostrom, NORNORM is on a mission to redefine the future of work by creating a fully circular business model for workspace furniture.

For more information, please visit www.nornorm.com

About Banco Santander

Banco Santander (SAN SM, STD US, BNC LN) is a leading commercial bank, founded in 1857 and headquartered in Spain and one of the largest banks in the world by market capitalization. The group’s activities are consolidated into five global businesses: Retail & Commercial Banking, Digital Consumer Bank, Corporate & Investment Banking (CIB), Wealth Management & Insurance and Payments (PagoNxt and Cards). This operating model allows the bank to better leverage its unique combination of global scale and local leadership. Santander aims to be the best open financial services platform providing services to individuals, SMEs, corporates, financial institutions and governments. The bank’s purpose is to help people and businesses prosper in a simple, personal and fair way. Santander is building a more responsible bank and has made a number of commitments to support this objective, including raising €220 billion in green financing between 2019 and 2030. In the first quarter of 2024, Banco Santander had €1.3 trillion in total funds, 166 million customers, 8,400 branches and 211,000 employees.

Santander Corporate & Investment Banking (Santander CIB) is Santander’s global division that supports corporate and institutional clients, offering tailored services and value-added wholesale products suited to their complexity and sophistication, as well as to responsible banking standards that contribute to the progress of society.